AMP Up Your Expectations

Anvil and AMP as the foundation of the future financial system

⚠️ Disclaimer

The information provided here is for educational and informational purposes only. It should not be considered financial advice. Please do your own research and consult with a qualified financial advisor before making any investment or financial decisions.

Table of Contents:

What’s the eurodollar system?

Collateral rules: All over the map

How did it all go wrong?

What happened when the system broke down?

Banks stopped trusting each other

Credit issuance plummeted

Liquidity tightened

Dollar Milkshake Theory

The economy “forgot how to grow”

The problem with USTs: Lack of neutrality & elasticity

What about Bitcoin and Lightning?

Anvil and AMP: Rebooting the Global Economy

Auditability

Collateral efficiency and fungibility

Backwards compatibility

Permissionless, extensible, and composable

Flexa

Empowermint

Conclusion

To figure out what Anvil and AMP are actually trying to fix, I realized I needed to get a handle on how the current monetary system works. Once I started, I ran into the eurodollar system.

If you want a deeper dive, The Snider Series is a great place to start.

What’s the eurodollar system?

Here’s the gist: the eurodollar system is this massive, decentralized network of banks and financial institutions that operate outside the U.S., but they’re all dealing in U.S. dollars. It’s not about physical cash moving around. It’s mostly ledger entries, promises to pay dollars, circulating globally. This system is huge. Much bigger than the actual supply of dollars inside the U.S., and it’s mostly invisible to central banks and official statistics.

If you want a quick explainer: What Is The Eurodollar System? (Must Know)

The eurodollar market really took off after WWII, when banks and companies wanted to move dollars around without getting tangled up in U.S. regulations. Over time, it became the main way dollars flow around the world, supporting everything from trade to complex financial products.

Collateral rules: All over the map

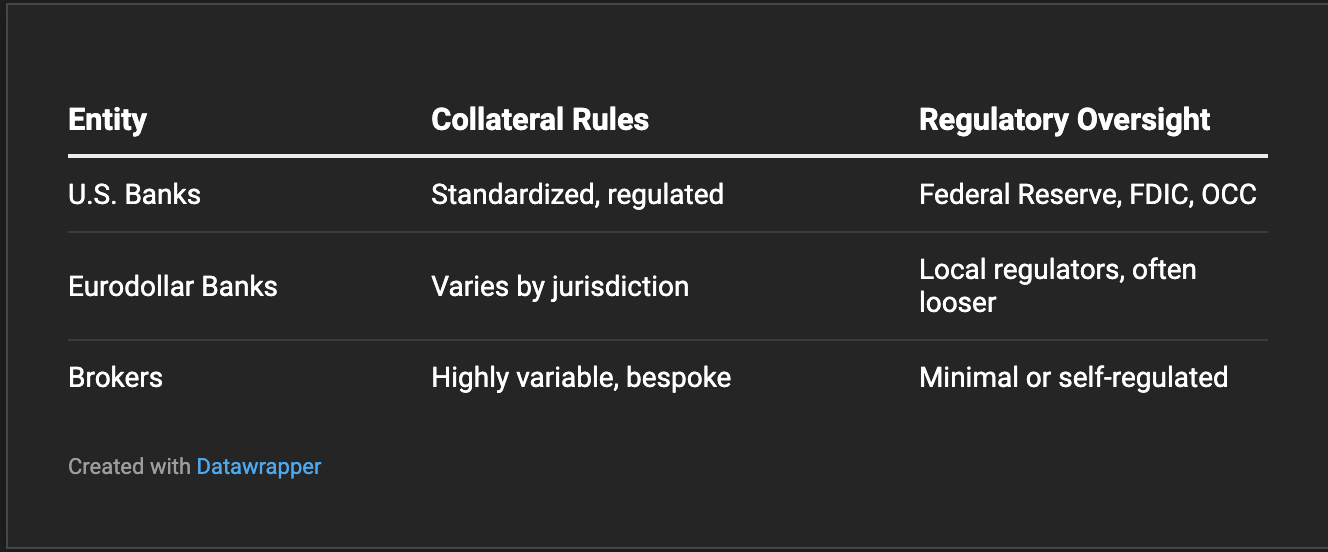

One thing that stands out about the eurodollar system is how inconsistent the rules are, especially when it comes to collateral. U.S. banks have standardized, regulated rules for what counts as collateral and how much you need. Eurodollar banks? Not so much. They’re governed by local rules, which can be looser or just different. Brokers are even more variable, often negotiating terms privately.

This patchwork leads to inefficiencies and risks. Banks can shop around for the easiest rules, which means more leverage and sometimes less safety.

How did it all go wrong?

Collateral Is The Most Misunderstood Yet Crucially Important Part Of The Monetary System

Jeff Snider points out that the eurodollar system’s growth was fueled by rehypothecation. Basically, using the same collateral over and over to back different loans. This created a ton of leverage, with banks making more dollar promises than they had collateral to support.

When the economy hit a rough patch in 2007-2008, this house of cards started to collapse. There wasn’t enough oversight, so risks weren’t managed well. As asset values dropped and banks got nervous about each other’s solvency, trust evaporated and the whole system started to unravel.

What happened when the system broke down?

The fallout was huge:

Banks stopped trusting each other

Suddenly, banks didn’t know who was safe to lend to. The eurodollar system is pretty opaque, so it was hard to gauge risk. Interbank lending froze up, and everyone started hoarding cash.

Credit issuance plummeted

With trust gone and balance sheets hurting, banks pulled back on lending. That meant less funding for businesses, governments, and regular people. The credit crunch made the recession worse and slowed down recovery.

Liquidity tightened

As credit dried up, global dollar liquidity shrank. Markets that relied on eurodollars found themselves starved for cash, which drove up borrowing costs and made asset prices swing wildly.

Dollar Milkshake Theory

Brent Johnson’s “Dollar Milkshake Theory” is a fascinating take on why the dollar can get even stronger during crises, even when the U.S. is printing more money.

Dollar Milkshake Theory EXPLAINED in this slide deck presentation by Brent Johnson

Basically, the world needs dollars to pay debts and for safety, so when things get shaky, demand for dollars spikes, even if the Fed is pumping out more. Ironically, this can lead to a global dollar shortage and make things even tougher for countries and companies that rely on dollar funding.

The economy “forgot how to grow”

You won't believe what is really behind the Fed's rate hikes & inflation rhetoric.

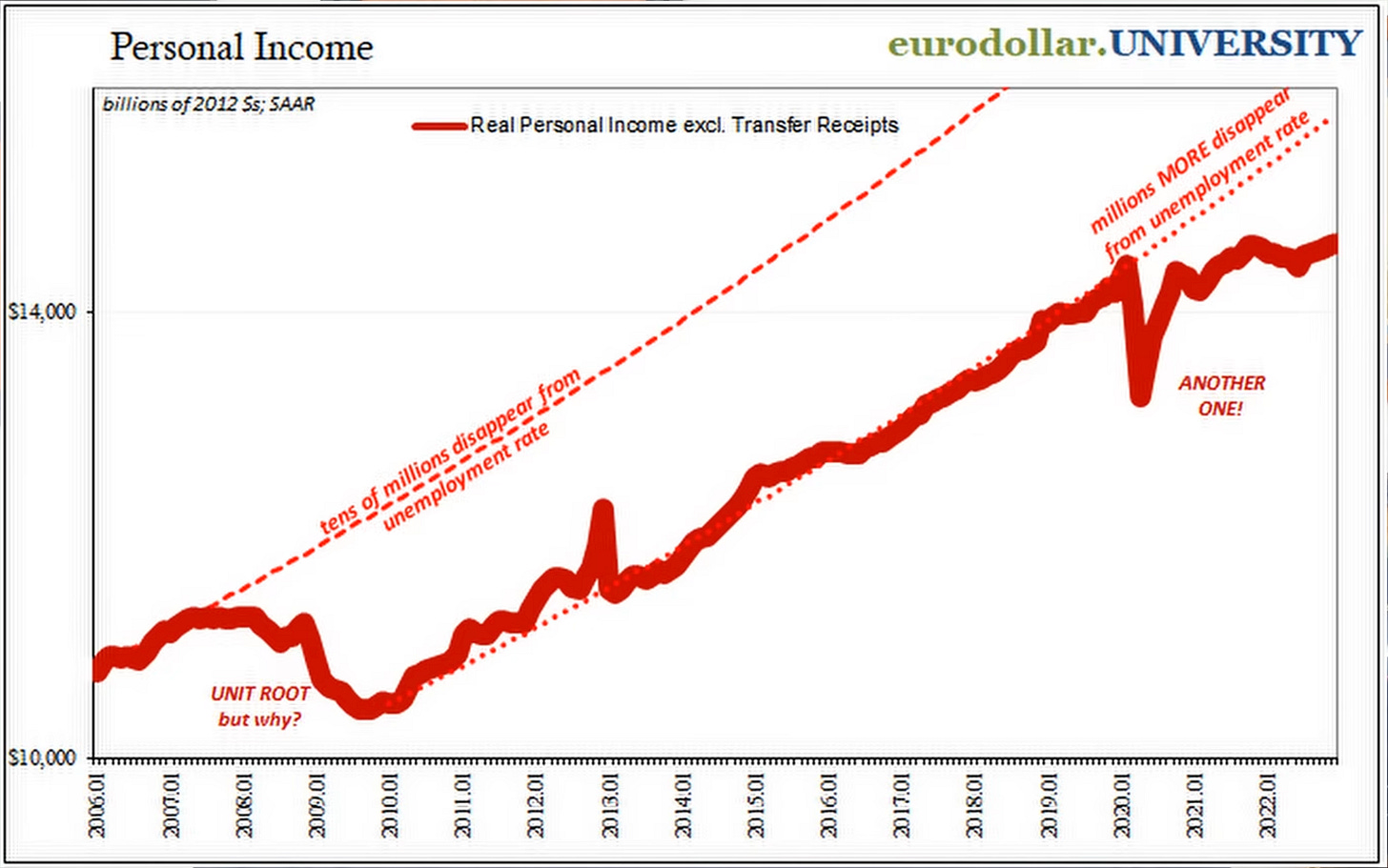

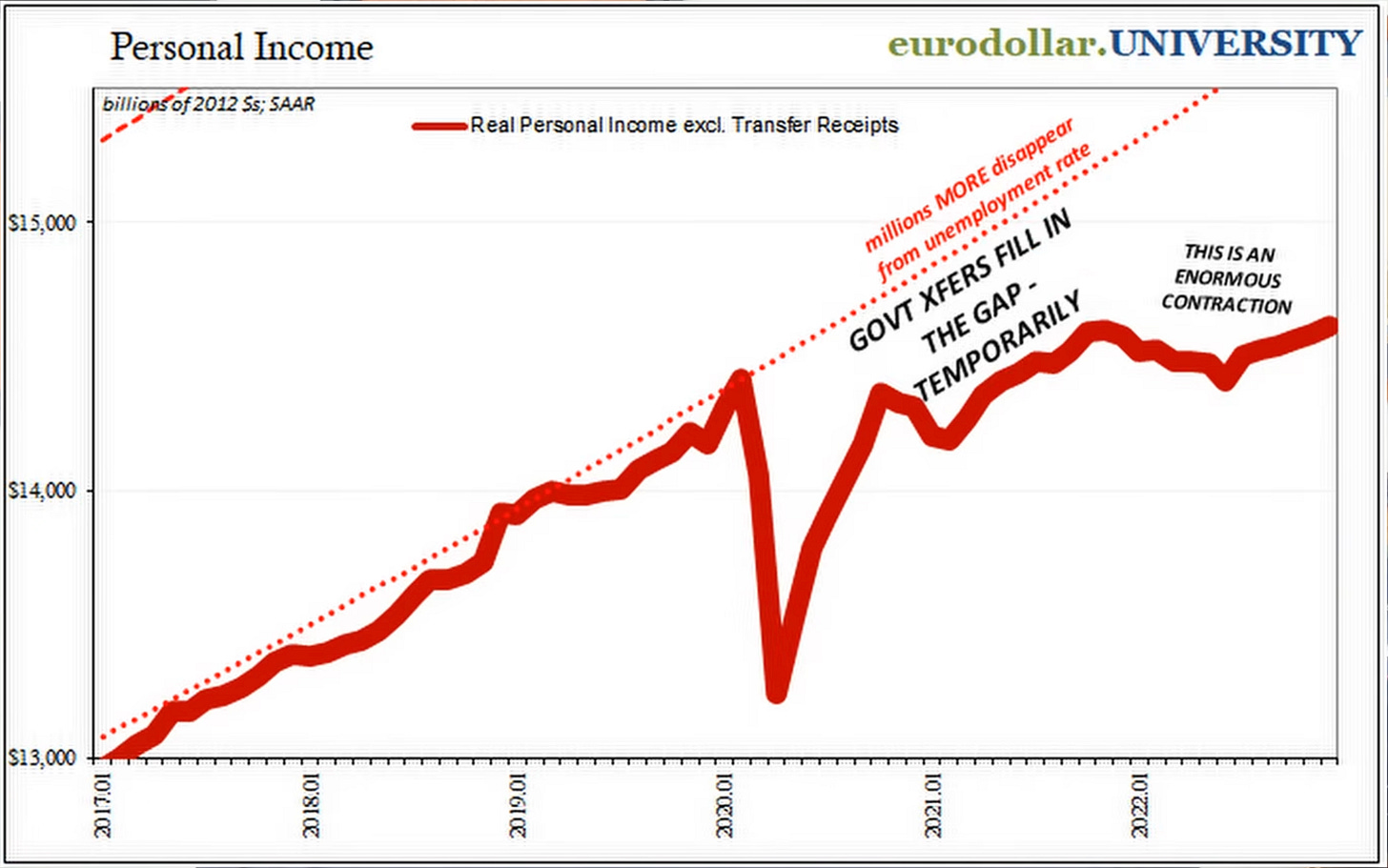

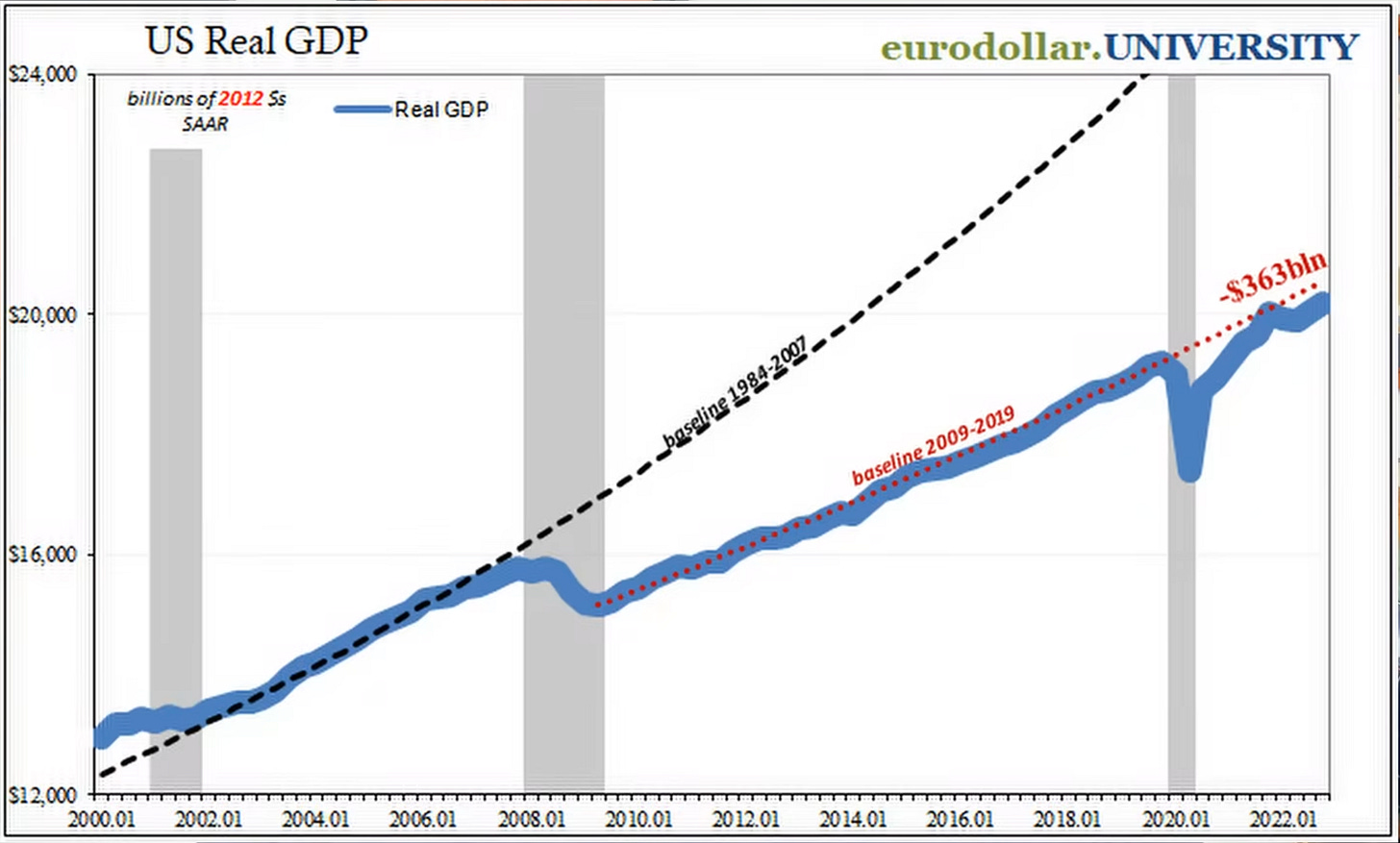

Jeff Snider often says the economy “forgot how to grow.” After the global financial crisis, credit stayed tight, and growth in GDP and personal incomes lagged behind historical trends. We never really bounced back to where we were.

Personal Income

US Real GDP

The problem with USTs: Lack of neutrality & elasticity

The main issue with USTs being the preferred global reserve asset is how they are created and managed. They’re increasingly tied to U.S. government spending, rather than responding to overall global demand. Basically, the supply isn’t flexible. It’s directly linked to how the U.S. government finances itself through borrowing. So, if there’s a big surge in demand, the U.S. government has to choose to issue more. It’s not an automatic process. This creates a gap where global demand doesn’t automatically translate into more supply. It is this lack of elasticity that fueled the highly leveraged eurodollar system. A system built on constantly finding ways to expand the availability of dollars, even if it meant taking on a lot of risk.

What about Bitcoin and Lightning?

EP76: The Founder Of Flexa Amptoken Tyler Spalding debates Going Parabolic

As Tyler points out in his conversation with John and GoingParabolic, the key thing is merchants need absolute certainty that a payment won’t be reversed. That’s economic finality. Bitcoin’s block rewards aren’t enough to back every transaction at retail scale. Lightning offers incredible speed and efficiency for payments, but it’s a Layer-2 solution. Those transactions happen off-chain and only settle on-chain when they’re written back. It doesn’t offer the same level of economic security as the base layer.

As of this writing, 1 BTC is worth ~$110k. Bitcoin’s block rewards are 3.125 BTC with a block time of 10 minutes.

3.125 * 6 * 110k = ~2m

The Bitcoin network provides ~$2m of economic security per hour. A large retailer like Walmart, with ~$100m in hourly revenue, would require significantly more to guarantee economic finality and protect against fraud. And that’s just one merchant, although it is the biggest one. Even if Bitcoin’s value increased many orders of magnitude, it’s simply not sufficient. This highlights the fundamental limitation of relying solely on Bitcoin for high-volume, secure payments.

Anvil and AMP: Rebooting the global economy

Anvil is designed to be simple but powerful. It tackles the eurodollar system’s biggest weaknesses, like lack of transparency and inconsistent collateral rules.

Auditability

Anvil tracks everything on-chain. That means anyone can verify collateral positions in real time, making the system much more transparent and reducing systemic risk.

Collateral efficiency and fungibility

Anvil sets common rules for collateral and credit issuance across regulated and unregulated participants, making assets more interchangeable and boosting liquidity. Reducing the need for costly legal processes to “perfect” collateral and enables automatic risk controls, which helps prevent big failures.

Plus, Anvil allows a wider range of assets to be used as collateral, so there’s more capacity for credit creation.

Backwards compatibility

Transitioning from the old system to something new is tricky. Especially when considering the large amount of existing leverage. Anvil supports familiar assets like U.S. Treasuries and bonds, so I’m optimistic that it could make it easier for institutions to migrate gradually reducing the risk of major disruption.

Permissionless, extensible, and composable

Flexa

Flexa’s integration with Anvil shows how payment networks and other use-cases can plug into open collateral protocols, creating new trust-minimized financial products.

To get a better understanding of AMP’s tokenomics, checkout Floating Ratio’s article: AMP–O-NOMICS — Key insights on the utility of Amp in Flexa Network

…AMP is what makes crypto payments actually work in the real world. A lot of people think accepting crypto is as simple as letting customers scan a QR code and send Bitcoin or Ethereum directly, but retail doesn’t work that way. When you’re running 600 stores and a customer is standing at the register, you can’t wait ten minutes for a blockchain confirmation. You need the payment to clear instantly, with zero risk to the merchant and zero friction for the customer. That’s exactly what Flexa solved and AMP is the core of how it works…

Empowermint

Empowermint is a great example of how Anvil can be leveraged by banks to extend credit efficiently and in a risk-minimized way.

Use any eligible digital token as collateral. Get alerted when important price fluctuations to your collateral’s value occur. Euros straight to any IBAN of your choosing. Whether it’s a traditional bank account or a bridge to a crypto debit card, if it has an IBAN, it can receive your loan disbursement.

Conclusion

Anvil isn’t just a new protocol. It’s the next iteration of the eurodollar system. Where the eurodollar network created global dollar liquidity through a web of untracked rehypothecation and inconsistent rules, Anvil brings transparency, standardization, and real-time auditability to the process of credit creation. By moving collateral management and credit issuance on-chain, Anvil could solve many of the inefficiencies and risks that have held back global growth since the global financial crisis.

And AMP? It has the potential to replace USTs and become the neutral, global reserve asset. As the Flexa network’s usage rises globally, merchant fees are used to buy AMP on the open market, which can drive up AMP’s price. Confidence in AMP as collateral will grow. The upward price pressure expands the collateral base, allowing the network to dynamically scale credit issuance through Anvil in response to global demand. Something “stable” assets like USTs can’t do.

If Anvil and AMP reach their potential, we could see a new era of trust, liquidity, and opportunity in the global financial system, helping the world remember how to grow.

…We are excited about this. The world’s new economic system is being built now and we can all own the framework. Banks and intermediary’s are no longer necessary, it’s peer to peer. It’s like being able to own the internet 20+ years ago. As fiat currency continues to be debased/devalued and manipulated, losing 10% of its value annually, the solution is here…